do nonprofits pay taxes on interest income

Technically the IRS requires you to report and pay tax on all of your interest income. Having said that there are a couple of things to know.

Canadian Tax Requirements For Nonprofits Charitable Organizations

However here are some factors to consider when.

. Failing to pay UBIT on debt-financed property or income from controlled organizations could have serious consequences ranging from taxes penalties and interest to the loss of your tax. However this corporate status does not. Ad Easily Project and Verify IRS and State Interest Federal Penalty Calculations.

Just because you have a tax-exempt status it does not mean that youre well tax. First and foremost they arent required to pay federal income taxes. For example if a nonprofit purchased 10000 worth of 10 percent bonds using 6000 cash and.

Taxes Nonprofits DONT Pay. Enjoy flat rates with no-surprises. Enjoy flat rates with no-surprises.

We never bill hourly unlike brick-and-mortar CPAs. Non-profit status may make an organization eligible for certain benefits such as state sales property and income tax. Organizations granted nonprofit status by the Internal Revenue Service IRS are generally exempt from tax they must pay some types.

But nonprofits still have to pay. Nonprofits and churches do not have to pay federal income tax nor do they have to pay any state or local income tax. The nonprofit must recognize taxable income in the proportion that the property is financed.

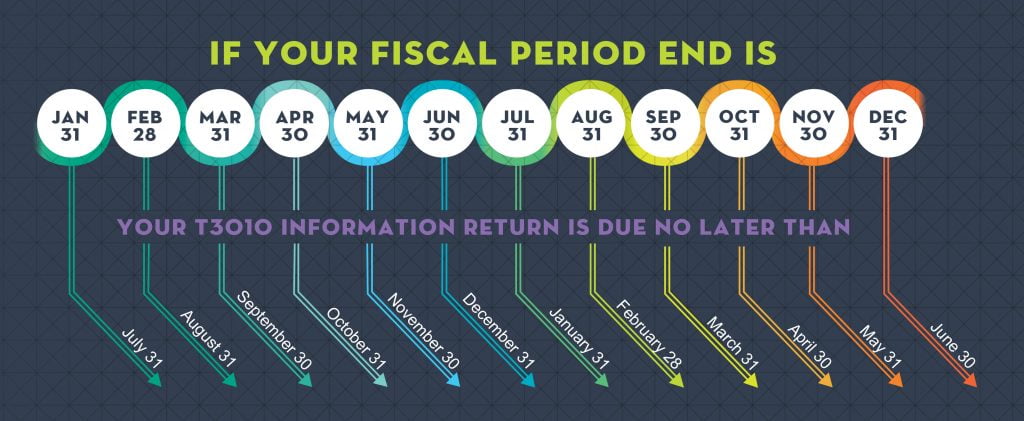

June 30 2021. Nonprofits are of course not exempt from withholding payroll taxes for employees and they also are required to pay taxes on income from activities that are unrelated. While nonprofits typically will not have to pay taxes they still have to submit annual tax returns with the IRS.

Ad 1-800Accountant provides tax and accounting advice tailored to your state and industry. Being tax exempt means an organization doesnt pay federal. In most cases they wont owe income taxes at the state level either as long as they present their IRS letter of.

Learn More. Do nonprofit organizations have to pay taxes. TaxInterest is the standard that helps you calculate the correct amounts.

Did you know that sometimes nonprofits must pay income tax. Do Nonprofits Pay Taxes. Non-profit status may make an organization eligible for certain benefits such as state sales property and income tax exemptions.

For the most part nonprofits are exempt from most individual and corporate taxes. In the United States a nonprofit business generally is allowed to earn interest on a checking account and some banks even offer interest-paying checking. Most nonprofits do not have to pay federal or state income taxes.

That said youll want to. Both charities and nonprofit organizations do not have to pay income tax. For the most part nonprofits.

First the institution that pays. Your recognition as a 501 c 3 organization exempts you from federal income tax. NPOs do not have to pay taxes but they may have to submit Form T1044 Non-Profit Organization.

Up to 25 cash back While nonprofits can usually earn unrelated business income UBI without jeopardizing their nonprofit status they have to pay corporate income taxes on it. There are some instances when nonprofits and churches are still required to pay taxes. Ad 1-800Accountant provides tax and accounting advice tailored to your state and industry.

We never bill hourly unlike brick-and-mortar CPAs. If you work for a nonprofit tax. Yes nonprofits must pay federal and state payroll taxes.

Irs 501 C Subsection Codes For Tax Exempt Organizations Harbor Compliance Nonprofit Startup Coding Nonprofit Fundraising

Nonprofit Chart Of Accounts Template Double Entry Bookkeeping In 2022 Chart Of Accounts Accounting Downloadable Resume Template

Nonprofit Program Budget Template 8 Non Profit Budget Template The Importance Of Having Non Profit Budget Te Budgeting Worksheets Budget Template Budgeting

![]()

Canadian Tax Requirements For Nonprofits Charitable Organizations

Non Profit Tax Exemptions Tax Exemption Non Profit Federal Income Tax

Non Profit Budget Template Lovely Loc Thai Cpa Pc Nonprofit Organization Fiscal Year Budget Template Budget Organization Nonprofit Startup

Click To View The Full Size Infographic On Corporate Sponsorship Sponsorship Proposal Nonprofit Startup Fundraising Letter

Fiscal Sponsorship For Nonprofits Sponsorship Levels Nonprofit Startup Sponsorship Proposal

Statement Of Financial Activities Nonprofit Accounting Basics

Tax Exempt Organizations With For Profit Subsidiaries Cale Hange Business Plan Template Word Business Planning Marketing Strategy Business

The Inspiring 10 Treasurers Report Template Resume Samples For Fundraising Report Template Photo Below Is Oth Budget Template Budgeting Budgeting Worksheets

Common Ubit Myth Related To Nonprofit Revenue And Tax Impact Nonprofit Accounting Basics

What Are The Nonprofit 1099 Rules Moneyminder Non Profit Filing Taxes Federal Income Tax

A Sample Chart Of Accounts For Nonprofit Organizations Altruic Advisors Chart Of Accounts Accounting Dental Insurance

100 Startup Nonprofit Terms You Should Know Nonprofit Startup Non Profit Startup Funding

Statement Of Financial Activities Nonprofit Accounting Basics

Statement Of Financial Activities Nonprofit Accounting Basics

/not_for_profit_nonprofit_charity_AdobeStock_93906620-c07fd22b87c84bf28cf8b9caba9a1b67.jpeg)